What’s ICHRA?

Challenges Facing Employers Today:

-

Health insurance costs are skyrocketing and out-of-control

-

Recruiting and retention challenges are rising

-

“One-size-fits-all” group insurance plans aren’t meeting employee needs

-

ACA non-compliance is leaving employers exposed to significant fines

-

ACA mandates for large employers are eroding employee compensation

-

Remote workforces are continuing to grow.

In simplest terms, the Individual Coverage Health Reimbursement Arrangement allows businesses of all sizes to offer employees a monthly allowance of tax-free money, allowing them to buy health care services that fit their unique needs while controlling costs and addressing ACA compliance.

Benefits of Individual Coverage HRAs for Employers

Flexibility

Employers can offer levels of

benefit per employee class

Attraction/Retention

Employees can

choose a health plan

tailored to their specific needs

Controlled Costs & Risk

Employers can take

control of the insurance

spending, contributions, and risk

ACA Compliance

Meets both mandates

of Minimum Value

and Affordability

Tax Efficiency

Helps employees pay for

individual health insurance

premiums tax-free, not

impacting their taxable income

Administration

With a benefits administrator,

ICHRA eliminates businesses

working between insurance

companies and employees

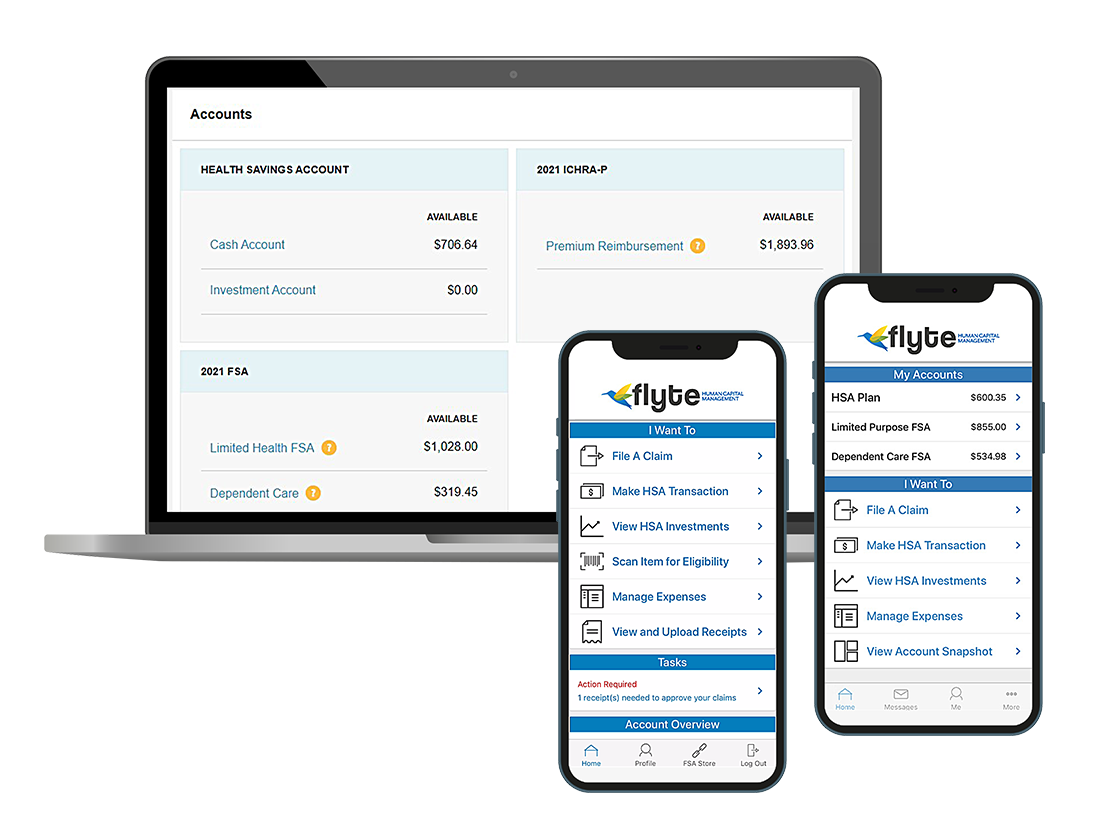

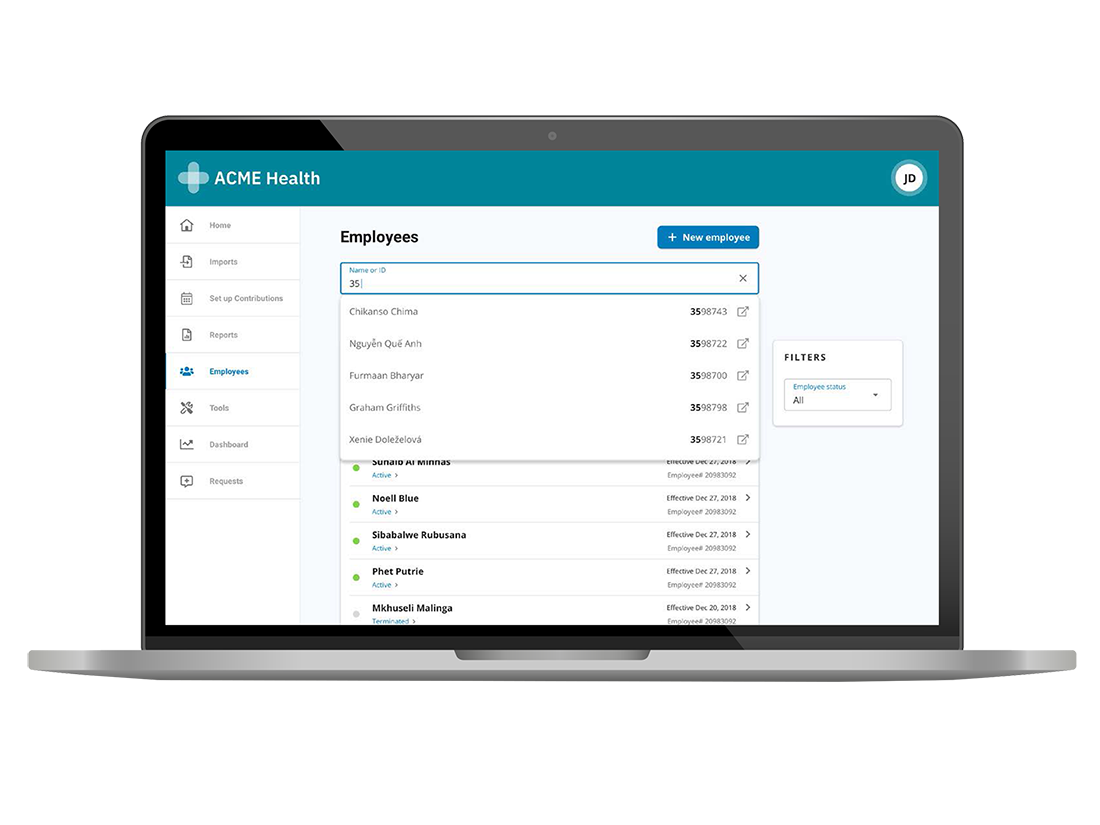

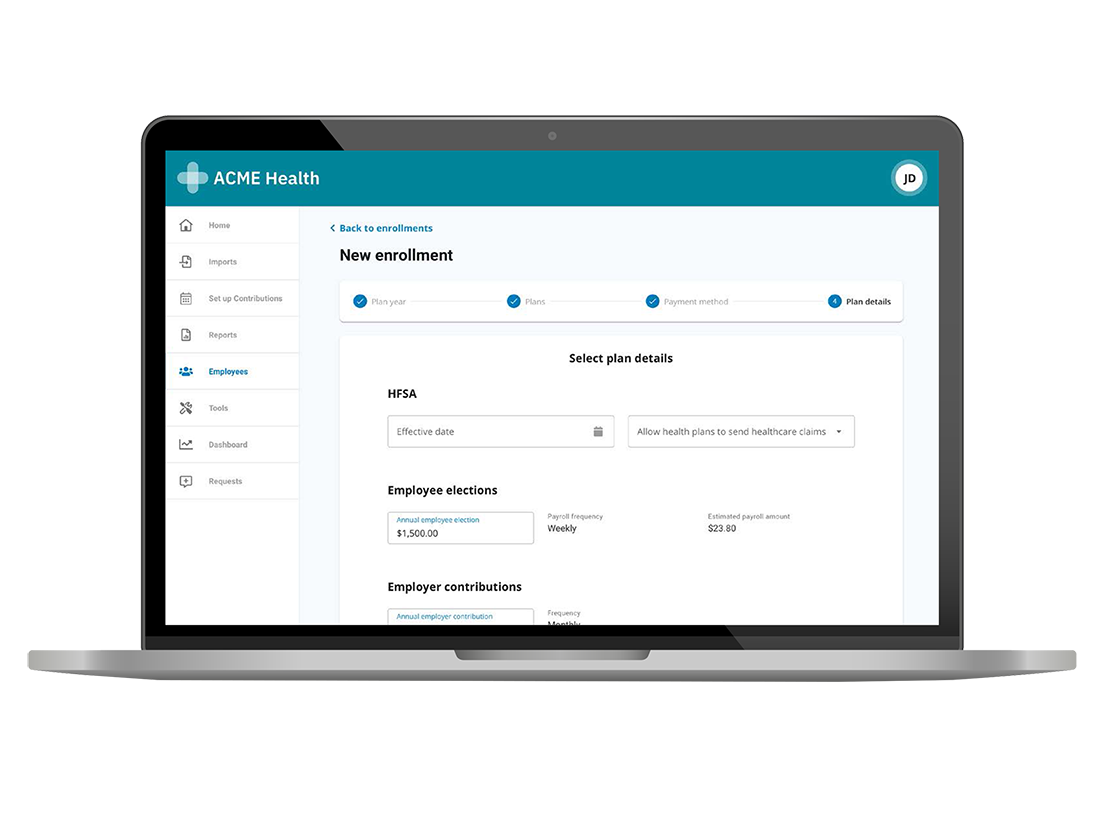

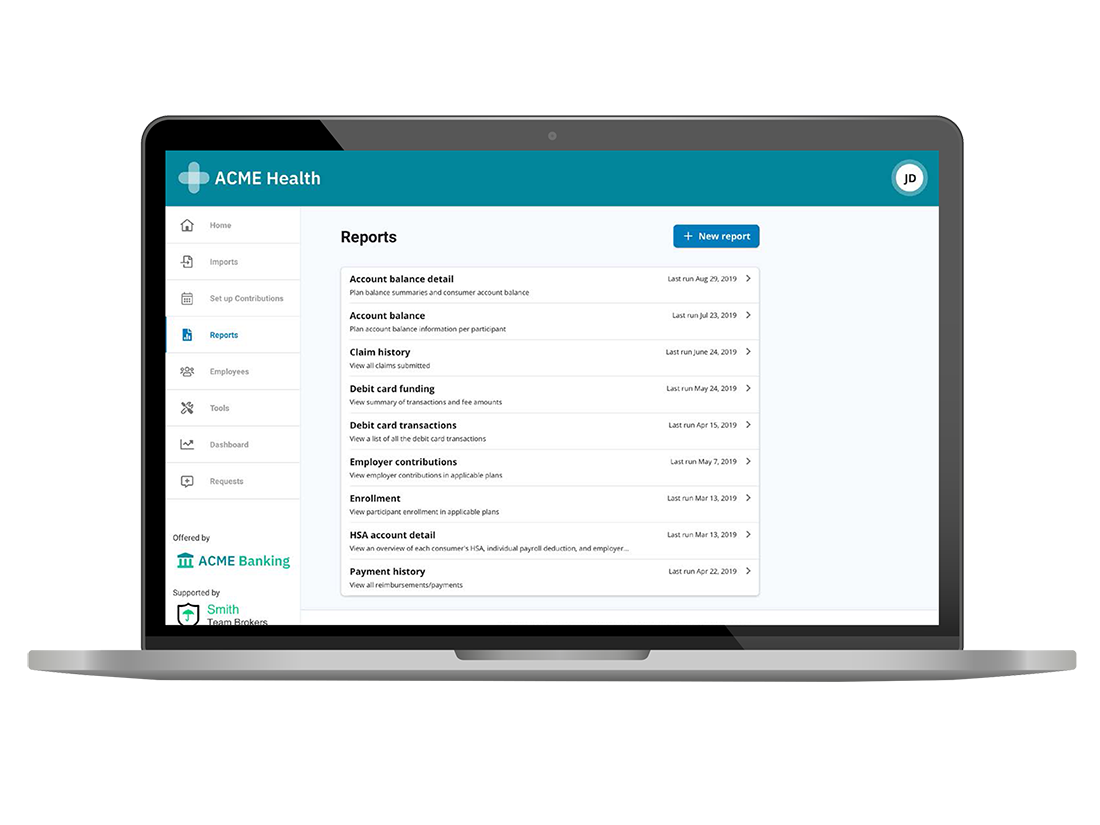

Individual Coverage HRAs, Driven by Technology…

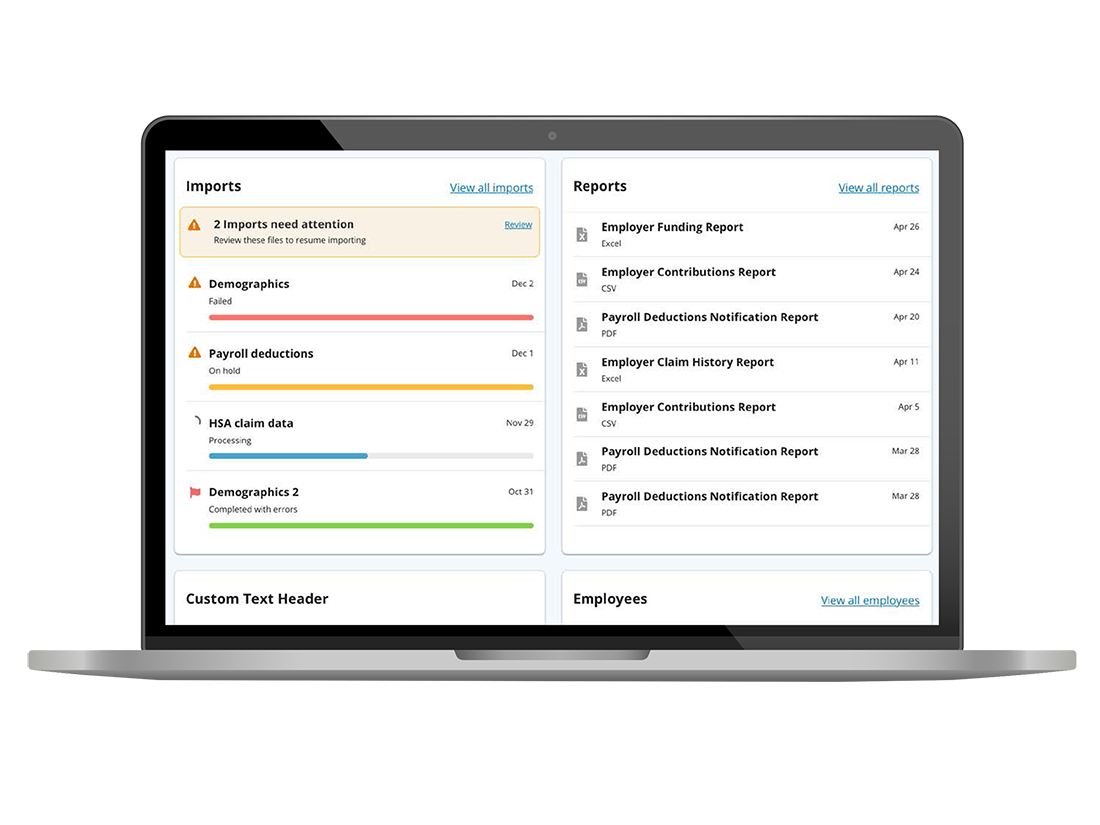

As an administrator of Individual Coverage HRA plans for our clients, Flyte HCM’s offering includes access to employer dashboards and reporting to streamline the process. Quickly access employee data, manage new enrollments, create real-time reports, and easily monitor your plan’s activity. We put it all at your fingertips!